xBank is a next-generation financial platform exclusively designed for SMEs and startups. Developed by Jade Labs and HVA Group, xBank integrates Web3 technology, blockchain, and digital banking to help businesses optimize budget management, digital asset control, payments, fundraising, and financial automation.

I. Market Context & The Reason for xBank’s Inception

In the era of global digitalization, businesses can no longer manage their finances using fragmented, non-transparent tools that do not support digital assets. Especially in Vietnam, where SMEs account for up to 97% of all enterprises, the need to access a flexible, cost-effective, and intelligent digital financial system has become more urgent than ever.

Key issues:

- Lack of financial infrastructure suitable for small business scale.

- Complex and difficult fundraising, especially for tech startups.

- Limitations in integrating digital assets and global payments.

xBank was created to thoroughly solve these problems. Developed as a “financial operating system,” xBank is not merely a digital bank, but a comprehensive platform that enables businesses to operate all financial activities in a transparent, optimized, and modern way.

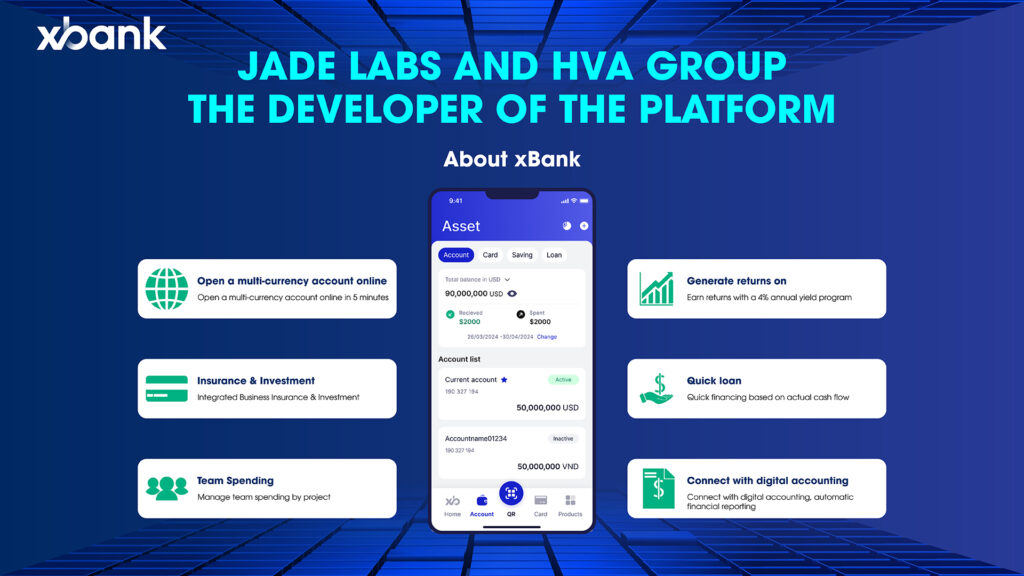

II. Jade Labs and HVA Group – The Developer of the Platform

Jade Labs and HVA Group is a leading fintech corporation in Vietnam, pioneering in digital assets and digital banking infrastructure. With a strong technological foundation, a team of experienced experts, and a vast integrated ecosystem, Jade Labs plays a central role in building and developing xBank.

- Jade Labs operates an ecosystem with over 5 million individual users through applications such as ONUS (Vietnam’s largest crypto investment and trading platform).

- More than 100,000 SMEs are partners or indirect clients within Jade Labs technology value chain.

- Strategic partners include organizations such as TrustPay, Vemanti Group, MISA, iPOS, and various ERP, POS, and Web3 platform providers.

Support from Jade Labs not only helps xBank develop superior technology but also enables rapid market expansion thanks to its pre-established ecosystem.

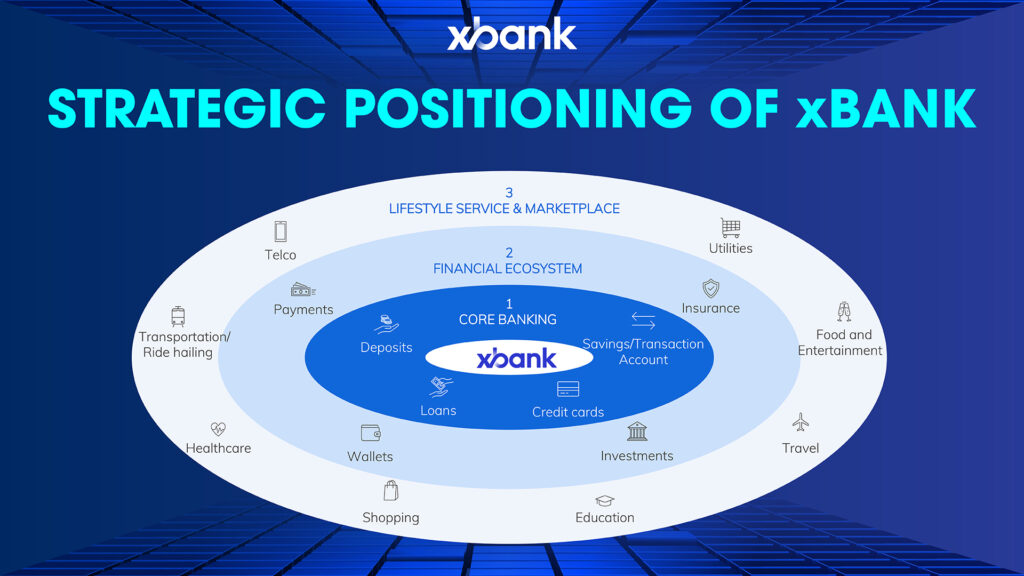

III. Strategic Positioning of xBank

xBank is positioned not simply as a digital bank, but as a “financial operating system” – a platform that integrates all business financial operations across both traditional (fiat) and digital (crypto) assets.

Operating Model:

xBank operates as a self-integrating and expandable ecosystem. Instead of providing individual banking services, xBank connects and controls the entire internal financial process of a business – from budgeting, expense approval, international payments, to lending and fundraising through digital assets.

Target Segments:

- SMEs: High demand for financial management automation, need for easy-to-use, low-cost integrated solutions.

- Tech and Web3 startups: Need tools to manage digital assets, integrate global payments, and access non-traditional capital.

Digital service and e-commerce enterprises: Need solutions that directly connect internal operations with financial platforms to optimize efficiency and cash flow.

IV. Outstanding Features – A Comprehensive Solution

xBank is not merely a digital bank or an e-wallet but a comprehensive Financial Operating System, designed to fully manage all business financial needs – from internal operations to market connectivity and capital raising.

1. Online Business Account Opening – Barrier-Free

Unlike traditional bank account opening processes, which are complex and require many procedures, xBank allows businesses to open accounts entirely online:

- No minimum balance required: Suitable for small businesses and early-stage startups.

- Fast verification through eKYC: Saves time and human resources for document processing.

- Immediate activation after approval: No need to wait weeks to use the account.

This helps businesses save 90% of the setup time and easily connect with the financial ecosystem when needed.

2. Budget and Expense Management by Delegated Model

One of the major difficulties for SMEs is controlling internal cash flow. xBank helps businesses:

- Create budgets by department, project, or employee group.

- Set up multi-level approval mechanisms: for example, accountant submits, department head approves, CFO gives final approval.

- Real-time monitoring: Budget reports are updated immediately upon transaction occurrence.

As a result, the executive team can monitor company spending transparently and make timely decisions.

3. Corporate Card Issuance – Physical & Virtual

xBank provides a highly flexible corporate card management system:

- Physical cards: Used by employees for business travel and POS payments.

- Virtual cards: Used for software payments, online services, or e-commerce purchases.

Accompanied features include:

- Setting spending limits per card.

- Tracking transactions by individual or department.

- Cancelling or creating new cards within seconds right on the admin interface.

This is a perfect solution for businesses lacking tools to control employee expenses.

4. Fast International Payments – Low Cost – Multi-Currency

Modern businesses increasingly require cross-border transactions. xBank solves this issue by:

- Flexible international transfers: Supports SWIFT, SEPA, and other electronic payment methods.

- More competitive exchange rates than traditional banks: Thanks to API connections with multiple global payment providers.

- Multi-currency system: Allows holding and converting between USD, EUR, VND, JPY, etc.

This feature is especially useful for tech startups, software companies, e-commerce, and global service providers.

5. Web3 Wallet Integration – Manage Both Fiat and Crypto on One Platform

A standout advantage of xBank compared to most traditional financial platforms is the ability to:

- Integrate high-security Web3 wallets supporting popular digital assets like ETH, USDT, BNB, etc.

- Allow businesses to store, send, receive, and manage digital assets alongside fiat currencies.

- Synchronize on-chain and off-chain transactions, enabling accounting to consolidate and control all cash flows.

This is a strategic step for businesses operating in Web3, blockchain, or those requiring cross-border crypto payments.

6. Automated Payments – Smart Contracts for Financial Operations

Instead of manually performing recurring tasks such as payroll, reimbursements, and dividend distributions, xBank enables automated “payment schedules” based on smart contracts:

- Automatically execute payments at fixed times monthly or via preset triggers.

- Eliminate errors and fraud risks, as all processes are transparent and immutable.

- All transactions are fully recorded on blockchain or internal logs.

This is a powerful tool for businesses to save financial personnel while ensuring compliance with audit procedures.

7. Flexible Lending Using Digital Assets

Businesses today face great difficulty accessing capital without collateral or perfect credit records. With xBank, businesses can:

- Use digital assets (crypto) like ETH, BTC as collateral for loans.

- Receive short-term loans with extremely fast approval time, thanks to automated credit scoring and internal financial data integration.

- No requirement to prove physical assets – a huge advantage for startups, tech companies, or new businesses.

This mechanism improves capital access while ensuring safety and risk control for the platform.

8. Smart Fundraising via NFT & Launchpad

One of xBank’s most unique features is the ability to tokenize assets or investment rights via NFTs, enabling:

- Converting equity, bonds, or profit-sharing rights into NFTs, making ownership transparent and easily transferable.

- Community fundraising via integrated Launchpad, allowing SMEs to access capital beyond traditional banks or funds.

- Managing post-fundraising cash flow directly on the xBank system.

This mechanism suits Web3 startups and opens new directions for traditional SMEs to access decentralized funding legally and under control.

V. Modern and Flexible Technology Architecture

Technology architecture is the core foundation that sets xBank apart from traditional digital banks and other fintech platforms. With the design philosophy of “open – modular – highly secure”, xBank is not just a financial application, but a flexible platform that can be integrated into any business ecosystem.

1. Omnichannel Interface Layer

xBank’s interface is optimized for various types of users:

- Mobile App (iOS/Android): for employees, managers, and daily users in the enterprise. The app features an intuitive interface, easy operations, and real-time notifications.

- Web Dashboard: for accountants, CFOs, and financial controllers, with advanced features such as multi-level approvals and report export.

- API for integration systems: businesses can connect the xBank system with existing software (such as CRM, HRM, and operational systems).

2. Customer Journey Layer

Through BPM (Business Process Management) tools, xBank can model and automate the entire internal financial workflow:

- From account opening, permission assignment, budget approvals to expense management and payment reconciliation.

- Supports customization according to the enterprise’s organizational structure.

- Integrates eKYC technology, digital identity, and automatic AML/KYC checks.

3. Open API Layer

xBank offers over 200 API endpoints for open integration with ERP, CRM, accounting software, and other systems.

- Includes a sandbox test environment for developers.

- Supports advanced security protocols (OAuth 2.0, JWT).

4. Core Financial Engine

xBank’s core system is developed under a microservices model, comprising the following components:

- Core Banking Engine: processes accounts, ledgers, transactions, and deposits.

- Card Engine: creates, manages, and orchestrates physical & virtual cards.

- Payment Engine: executes domestic (Napas, interbank transfers) and international (SWIFT, SEPA) payments.

- Crypto Engine: manages digital assets, cold/hot custody, and on-chain transactions.

Outstanding features:

- Separates data and processes by domain, enhancing security.

- Enables updates to be deployed without impacting the entire system.

5. AI & Data Analytics Layer

The Data Lake is optimized for real-time storage.

- Integrates analytics tools such as Power BI, Tableau.

- AI models support:

- Internal credit scoring.

- Abnormal behavior detection.

- Enterprise cash flow forecasting.

6. Cloud & Security Layer

xBank is deployed on cloud-native platforms (AWS, Azure), allowing for:

- Automatic scalability according to load.

- Multi-region deployment ensures service continuity.

High-level security:

- AES-256 data encryption.

- Two-factor authentication (2FA), OTP, anti-phishing.

- Compliance with ISO 27001, PCI-DSS, GDPR standards.

xBank’s technology architecture not only ensures smooth operations but also allows businesses to flexibly integrate, customize, and scale without limits. This is the foundation for xBank to become the “financial center” in the operational ecosystem of every enterprise – from SMEs to large corporations.

VI. Deployment Capability & Supporting Ecosystem

Flexible Deployment – Shortened Timeframe

- For SMEs: can be deployed under the SaaS model; just register an account and start using it within a few days.

- For large enterprises: xBank can be integrated under on-premise or hybrid models, with implementation time of 1–3 months depending on customization requirements.

Diverse Integration Ecosystem

- ERP & POS: Direct integration with MISA, FAST, Bravo, Kiotviet, iPOS.

- E-wallets & Payment Gateways: MoMo, ZaloPay, OnePay, PayME.

- Web3 Partners: NFT platforms, crypto exchanges, launchpads.

Thanks to its open technology platform, xBank can become the core component of the financial system for all types of enterprises.

VII. Strategic Partnership and Investment Opportunities

Opportunities for Investors

xBank is a unique fintech model because it does not compete directly with traditional banks but provides tools that help enterprises operate finances more efficiently. This allows the model to scale easily, with low cost and high profitability:

- Targeting 5 million SMEs in Southeast Asia.

- B2B SaaS model creates recurring cash flow.

- Capable of deep integration into multiple industries.

Opportunities for Integration Partners

- Provide financial services to existing enterprise customers.

- Enhance the value of ecosystems (ERP, accounting software, e-commerce services…).

Opportunities for Startups and Web3 Community

- Use xBank as a tool for fundraising, cash flow management, and international expansion.

- Create NFTs representing assets, issue tokens tied to real economic benefits.

VIII. Conclusion – xBank: The Financial Future for Modern Enterprises

In a world where speed, transparency, and adaptability are mandatory, xBank is the platform that helps businesses get ready to step into the digital finance era.

- For SMEs: A cost-effective, flexible, and easily integrated financial solution.

- For tech startups: A bridge between digital assets and corporate finance.

For investors: An opportunity to invest in a fintech model with regional scalability.

Jade Labs and xBank are opening the door to a new generation of financial platforms – where every business, large or small, can manage and grow their finances in a smart and proactive way.